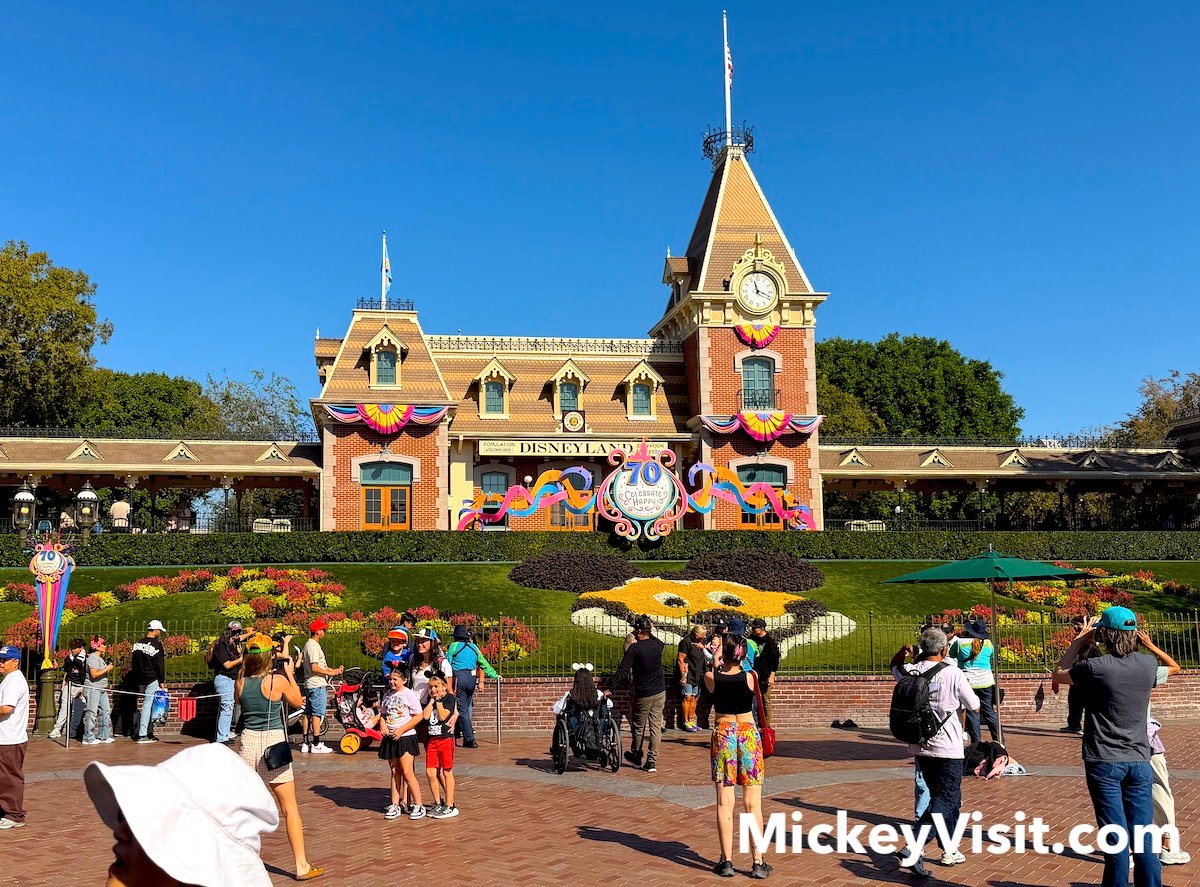

Disney’s theme parks continue to be the most important part of the entire company. Today we received an update on The Walt Disney Company as a whole, including a couple of exciting announcements and comments about the future of the company. Disney is in the middle of a massive theme parks expansion and deeper expanded success of their streaming entertainment business.

Today, we received an update on The Walt Disney Company overall during their quarterly earnings call. We’ll dive into the impactful news from the call for all theme park fans. At Mickey Visit, we bring you the latest Disney theme parks news and planning resources, including a restored broken special effect and a clarification on Disney line rules. You can see our write up of last quarter here and a look at potential Disney changes under the new CEO here.

READ MORE – Rides Disney Almost Built But Didn’t (And Why They Never Happened)

Disney Parks Overall Success in End of 2025

Disney Experiences hit a record $10 billion in quarterly revenue in Q1 of Fiscal 2026. They delivered $3.3 billion in operating income. Compare this to the overall $4.6 billion operating income from the entire company. Disney Experiences drove 71.7% of total segment operating income this quarter.

Disney Ride Closure ALERTS, Major Changes, Secrets Revealed

Get alerts on closures, park changes, exclusive discounts, and free printables. Trusted by 100,000+ Disney fans & planners.

Domestic Parks & Experiences operating income grew by 8%, driven by a 1% increase in attendance and a 4% increase in per capita spending (guests are spending more per person as theme park prices have increased).

The 1% increase in attendance benefits from a comparison to the quarter a year prior that was impacted by a hurricane in Orlando that reduced Walt Disney World attendance. That really means that the attendance was flat to slightly down when compared to the previous year based on the stated hurricane impact.

Note that Q1 of Fiscal 2026 includes calendar dates of October-December 2025.

Demand for Disney Theme Parks and Cruises

Disney warned of “modest” growth in Q2 2026 due to international visitation headwinds and costs associated with launching new ships (the Disney Adventure out of Singapore) and new themed lands (World of Frozen at Disneyland Paris).

Looking ahead to the entire year, Disney CFO Hugh Johnston shared a view into bookings as they currently stand. He shared that Walt Disney World had a good quarter built upon strong guest attendance and pricing performance, or in other words the amount that each of the guests who visited spent on their trip. He shared that Walt Disney World bookings are currently up 5% for the full year and that they are weighted more toward the back half of the year.

Johnston also shared that they have a lack of visibility into the international visitation because fewer of those visitors stay in Disney hotels.

Future of the Disney Theme Parks as Key Element of Disney

Disney has leaned into intellectual property as the core of their entire business. Whether from the stories that they created through the animation studios or acquired at Pixar, Marvel, Star Wars, or FOX, these have become the critical part of the business. This is especially true in the theme parks.

As I have previously written, in my review of what could be the best theme park ride in the world, using existing intellectual property creates a built-in audience for whatever the new theme park addition is and should push more people to want to visit with less context. In many ways it de-risks whatever new addition because there are already known people who will want to see it.

During the call today, an analyst asked Bob Iger to compare the Disney Experiences business today vs the business when he became CEO and to look ahead to whether the Disney Experiences business would still be the driving force in 5-10 years vs the entertainment business.

I’ve included Iger’s full response below because it was illuminating and a helpful way to understand how Disney is thinking about the future of their business.

Bob Iger shared –

If you go all the way back to 2005, when I became CEO, the return on invested capital in the then parks and resorts business was not impressive and actually not acceptable. We also had not that much building in progress, meaning there wasn’t much expansion happening, but maybe for good reason because the return on invested capital was so low. As we added IP to our stable, including Pixar in 2006, Marvel in 2009, Lucasfilm / Star Wars in 2012, and ultimately 20th Century FOX, we gained access to intellectual property that had real value for parks and resorts and enabled us to do more capital spending because of the confidence level we had in improving returns on invested capital due to the popularity of that IP.

When you look at the footprint of the business today, it has never been more broad or more diverse. The projects that we have under way are going to make it even more so. Having been in Abu Dhabi just two weeks ago, I was reminded how great the potential is to build in that part of the world, because not only is it strategically located to reach a huge population that has never visited one of our parks, but it will be built in one of the most modern and technologically advanced ways. So, as I look ahead I actually am very bullish on that business and its ability to grow because of everything I just cited.

In addition though because of what Hugh said about our streaming business and what we know is in the pipeline in our movie business and also looking back just a few years when our movie business was suffering from COVID and the streaming business was not in an acceptable place, it is clear that the future of both of those business is also bright and going to grow.

There is now healthy competition at our company in terms of which of those two businesses is going to essentially prevail as the number one driver of profitability at the company, but I am confident that both have that ability, meaning that both have the ability to grow nicely into the future given the investments that we’ve made and the trajectory that we are on.

Disney Global Theme Park Expansion

Disney is in the middle of efforts to turbocharge its theme parks around the world with a planned investment of $60 billion into Disney Experiences over the next decade to bring new attraction capacity (see new rides at Disneyland and new rides at Disney World) and more new cruise ships.

Today, Bob Iger shared that, “our efforts to turbocharge this segment are well underway, and we are excited about continued progress on a robust pipeline of projects to support long-term growth. We have expansion projects underway at every one of our theme parks.”

He then pivoted to talking about the upcoming openings. “Next month, we will welcome guests to the new World of Frozen at the completely reimagined Disney Adventure World at Disneyland Paris. This milestone marks the beginning of a bold new era for Disneyland Paris, nearly doubling the size of the second park and showcasing Disney’s unique ability to bring our stories to life in the physical world.”

Next, he talked about the expansion of the Disney Cruise Line. “We recently launched the Disney Destiny, which has received outstanding reviews from guests since its maiden voyage on November 20. The Disney Adventure, our first ship homeported in Asia, is on its way to Singapore for its maiden voyage on March 10, bringing immersive Disney storytelling to more people globally than ever before. This will bring our fleet to a total of eight cruise ships, with another five scheduled for launch beyond fiscal 2026.”

Iger shared that “this quarter reflects our focused execution and investment across each of our strategic priorities and stands on the solid foundation we’ve built over the past three years, providing us with a path for long-term growth.”

New Disney Theme Park Activations Planned

In the executive statement, Iger also talked about the ongoing work at the theme parks to bring current Disney entertainment hits to life.

He talked about the upcoming additions and new experiences in the parks, that will include new experiences featuring Bluey, activations planned around the release of Toy Story 5, and a new mission featuring the Mandalorian and Grogu inside Millennium Falcon: Smugglers Run coming soon.

We aren’t sure if the Toy Story 5 mention is just in reference to the expanded Toy Story offerings at Walt Disney World this summer during the Cool Kids Summer event (I actually really like what they are doing with Jessie’s Roundup), or if there will be further announcements around that release. I would expect to see more around that movie and perhaps some interesting character offerings or some sort of celebration at both Disney California Adventure and Disney’s Hollywood Studios.

READ MORE – This Is The Coolest Moment of the Day at Disney California Adventure You Won’t Want to Miss

Zootopia and Avatar Delivered as Major Disney Franchises

Disney looked back at the quarter that delivered two billion dollar grossing films. They first summarized the successes of the year stating, “our film studios generated more than $6.5 billion at the global box office in calendar year 2025, making it our third biggest year ever and our ninth year as #1 at the global box office in the last 10 years.”

They then addressed Avatar and Zootopia 2. “Avatar: Fire and Ash was our third release in 2025 to cross the $1 billion box office threshold, joining Zootopia 2 and Lilo & Stitch. Zootopia 2 also became Hollywood’s highest-grossing animated film ever and one of the top ten highest-grossing films of all time, earning nearly $1.8 billion at the global box office and firmly establishing itself as a popular new franchise for the company. To date, 37 billion-dollar films have come from our studios out of the 60 films that have hit this mark industrywide, and we have four times as many as any other studio.”

They also emphasized the franchise nature of these new movies. Specifically about Zootopia 2, they talked about how the film “lifted viewership of related titles on Disney+ and fuels global interest in our parks and consumer products.”

They also emphasized the success of the film in China. “Zootopia 2 is the highest grossing Hollywood film of all time in China, earning more than $630 million at the box office so far. This franchise is also an important driver of attendance at Shanghai Disneyland with our Zootopia-themed land – one of the most popular areas of the park.”

Disney’s 2026 Movie Slate Set to Deliver

Bob Iger emphasized that they have a big slate of 2026 films on the way.

They specifically noted 20th Century Studios’ The Devil Wears Prada 2, Lucasfilm’s The Mandalorian and Grogu, Pixar’s Toy Story 5, Disney’s live-action Moana, and Marvel Studios’ Avengers: Doomsday.

In addition, they also emphasized the value of these films when they come to Disney Plus and the amount of demand and viewership that they drive. They noted that Zootopia 2 and Avatar: Fire and Ash are both expected to be big engagement drivers on the service this year.

Improvements to Disney Plus App Experience

They also provided an update on the Disney Plus app experience. “We’re rolling out numerous product enhancements to elevate the user experience on Disney+, advancing work to improve our recommendation engine, and exploring opportunities to use AI to further increase personalization.”

They specifically stated that they aim to improve the app homepage experience. “Our refreshed Disney+ homepage, which launched in the fall, features streamlined navigation, a dedicated “For You” section, and a more modern, intuitive design, with additional updates in the works. Ongoing experimentation remains central to how we innovate, and we expect new ad tech capabilities such as our AI-powered planning tool and video generator to improve advertiser engagement.”

Iger also discussed the importance of the Disney bundle. “We know that the bundled subscribers churn out less. We are hard at work on the technology front to create the one app experience.” Consumers will always be able to buy Disney Plus or Hulu on their own, but Iger stated they “believe the great majority of consumers will buy both.” They expect the one app experience to launch by the end of calendar 2026.

New OpenAI Vertical Video Integration

Disney previously announced their partnership with OpenAI to allow users to create Sora-generated videos of more than 200 Disney characters.

They shared that sometime in fiscal 2026 (so before October 2026), they will roll out the Sora content. They plan to stick to a 30 second video limit.

They also emphasized that this is a 3 year agreement that Disney is being paid for.

Iger stated that they “have for a while wanted to include user generated and short form content on Disney Plus.”

He then also spoke a little bit about how he and Disney view AI. He said that they view AI as helpful in three ways – as a tool to support the creative process, as a way to increase productivity, and as a way to connect with the consumer to have a more effective relationship. He views the Sora content as fitting in that last bucket.

How Does Disney Compare to Ongoing Warner Brothers Discovery Bidding?

An analyst asked about the ongoing battle by Paramount and Netflix to purchase Warner Brothers Discovery. Iger said that the fight should “give emphasis to or cause investors to appreciate the tremendous value of our assets, particularly our IP.”

He said that it reminds him that the FOX deal Disney did in 2019 was ahead of its time. He knew that they would need more volume for their scale and still believes that acquisition was well priced considering what is being offered for the Warner Brothers Discovery assets.

He pivoted to talking about the power of IP and success of the Disney Experiences business as he finished answering the question as an illustration of the value of the Disney IP beyond the big screen in the theaters. He stated that billion dollar movies throw off real long term value. He believes that they don’t need to buy more IP and have “a bedrock of stories already told to grow from.”

Comments on Disney’s Next CEO

We are likely days away from the selection of Disney’s next CEO. Last week I shared the “irresistible case” for the top candidate. Please read that analysis for a deeper understanding of the leader who is expected to be announced this week.

Multiple analysts pushed Disney CEO Bob Iger to address the next steps that a future CEO should take in the company. One analyst asked about if there were any clear moves that a successor could take on the level of acquiring Pixar or shifting Monday Night Football to ESPN the way that Iger did in 2005.

Iger discussed the “tremendous amount that needed fixing three years ago” and stated that he believes “the company is in a much better place than it was three years ago.” After talking about where the company was going, he specifically again noted the investment across the Experiences division as critical establishment of future opportunities. He said that the company was positioned well for his successor to move forward.

He also spoke specifically to the company structure where the creative leaders of the studio and television business also control the P&L of streaming and distribution. He stated that he believes any organization that is creative should be created with an eye towards creative and maintaining accountability for the investment into new projects.

He encouraged the new leader that “in a world that changes, you also have to continue to change and evolve as well.”

Other Disney Company News

Generally, it is important to understand how the rest of the Walt Disney Company is performing beyond the theme parks. It gives us a better understanding of where investments will be made in the future.

For instance, understanding that shifts in the linear TV business led the Disney theme parks to become the main profit driver for the entire company explains why Disney is increasing theme park prices and investing so much more in this area.

As I mentioned in the introduction of this article, for a long time, the cable business was the biggest driver of growth and profits for The Walt Disney Company. That was largely anchored on the success of ESPN. Analysts would quip, “as goes ESPN, so goes Disney”. That saying has largely changed to “as goes Disney theme parks, so goes Disney” today, but the TV assets are still important to the business.

The Entertainment Direct-to-Consumer business continues to be profitable, contributing $450 million in operating income this quarter. Revenue for streaming increased 11% compared to the prior year. Disney expects streaming margins to reach 10% by the end of the fiscal year.

Sports operating income fell to $191 million (a $56 million decrease). This was largely due to a $110 million hit caused by a temporary carriage dispute with YouTube TV and rising programming/production costs.

While Entertainment revenue grew (thanks to theatrical hits like Zootopia 2 and Avatar: Fire and Ash), operating income for the segment declined by $0.6 billion due to higher marketing and production costs.

Despite the dip in Q1 profit, CEO Bob Iger is projecting “double-digit” adjusted EPS growth for the full fiscal year 2026, suggesting they expect a much stronger second half of the year.

We are closely watching for the latest Disney news to bring you the critical updates that you need to know.

Don’t Miss the Latest Disney News

Don’t miss the latest Disneyland and Disney World news from Mickey Visit. Join the FREE Mickey Visit newsletter that over 100k readers receive every single week. Mickey Visit is here to help you save money and experience more during your Disney and Universal vacation. See the Mickey Visit guide to Disneyland and the Mickey Visit guide to Disney World for tips.